Better Internet poker Web sites for all of us Professionals 2025 Update

Articles

You to definitely income could be subject to part 3 withholding tax, because the mentioned before. A questionnaire W-8BEN or a questionnaire 8233 provided with a great nonresident alien in order to score treaty professionals does not need an excellent You.S. TIN if you, the new withholding representative, fulfill all of the after the criteria. Around the world groups are excused of You.S. taxation for the all U.S. origin money. Earnings paid back in order to a major international team (inside the concept of point 7701(a)(18)) is not subject to section 3 withholding. Worldwide groups commonly required to offer an application W-8 otherwise documentary facts to get the newest exemption should your term of one’s payee is but one which is designated since the an international team because of the administrator acquisition.

If the somebody try a different flow-due to entity otherwise a foreign intermediary, your pertain the newest payee dedication laws and regulations to that partner to decide the new payees. Fundamentally, a supplier that is a great nonresident individual have to document a great Maine taxation come back on the income tax seasons when the brand new selling of your own Maine assets happened in order to calculate any Maine taxation due otherwise overpaid. A return is not required should your investment obtain in the sales, together with most other Maine-source taxable income, doesn’t trigger a good Maine taxation liability. One claim to own reimburse from an overpayment away from withholding need to be registered inside 36 months in the deadline of your get back otherwise three-years since that time the brand new tax is actually paid back, any type of ends after. For additional info on the newest Maine processing requirements, come across Maine Code 806, the new Faq’s to have personal tax (Concern 6), and the guidelines to have Function 1040ME and you can Plan NR or NRH from the /money.

When the spacious rooms be your personal style, you can imagine committing to undeveloped house as opposed to structures, paths, harvest, or tools. It’s constantly lesser to find, and you can a secure financing will help you within the developing they. While you are risky, house flipping can result in a substantial salary once you offer, which you’ll next use to spend money on the next assets. Some other winner has been commercial a house, supercharged because of the pandemic-determined increase inside the age-commerce.

Beneficial Funding and you may Tax Professionals

The relationship, or a great withholding representative to your union, must pay the new withholding taxation. A partnership that have to spend the money for withholding taxation however, fails to take action is generally accountable for the fresh fee of the tax and you may people punishment and you will desire. If one makes an excellent withholdable commission to help you an organization claiming specific section cuatro statuses, you’re necessary to obtain and you may be sure the new organization’s GIIN against the authored Internal revenue service FFI number within ninety days to rely on such as a state. Discover GIIN Confirmation less than Standards of real information to have Purposes of Chapter 4, prior to, in which section cuatro statuses wanted a GIIN.

Precisely what do You should Benefit In the Home?

That said, Return on your investment computations are just one tool inside comparing potential assets. Venue, property reputation, industry manner, and https://wjpartners.com.au/dreams-casino/ your investment schedule the play very important opportunities in the manner winning you’re. FinCEN solicited comment on the newest Proposed Signal as well as revealing framework—statements is due because of the April 16, 2024. All-cash requests away from residential a house are thought from the high risk for the money laundering. The fresh rule would not require the revealing from conversion process to people.

REITs are purchased and you will obsessed about the big exchanges like most other inventory. You can find a a home selling when you’re well-told on the market trend and financial outlooks. The greater amount of education you may have of your market and you will local parts, the better told the behavior will be.

Can i become an accredited trader to utilize genuine estate investing applications?

Zero financial insurance policies on the financing with no restrictions to possess prepayments. Is romantic ninety days through to the beginning of the a new income secured jobs playing with one to earnings to be considered. Current money from cherished one welcome to have closing rates / prepaid service expenses or advance payment.

Tough Currency Finance, Residential

The firm possess flat products throughout the The newest The united kingdomt, the brand new York City metropolitan area, Washington, D.C., Seattle, and you can California. The organization is the third-biggest proprietor from apartments regarding the U.S., that have a profile sized nearly 80,one hundred thousand flat products along side says. Particular renowned services owned by the firm is Avalon North Route, Avalon West Hollywood, and Avalon Glendora. Let’s state you get property to possess $250,100000 that have 20% off, or $50,one hundred thousand.

A home common fund dedicate primarily inside the REITs and you may a home doing work businesses. They give the capability to acquire varied experience of a home having a comparatively number of funding. Based on their method and you may diversification needs, they offer buyers having far wide asset possibilities than simply might be attained because of to buy individual REITs. Investment organizations (REIGs) is actually sort of such quick common financing for rental characteristics. If you want to very own accommodations possessions but wear’t require the trouble of being a property owner, a bona-fide estate financing class is the provider for your requirements. REITs purchase many different services including malls (on the one fourth of all REITs concentrate on such), hospitals, mortgages, and you can office houses.

- Home now offers of numerous options and you will unbelievable tax benefits.

- The fresh WT have to withhold on the time it can make a shipping away from a withholdable commission or a price at the mercy of chapter 3 withholding in order to a primary overseas recipient otherwise proprietor.

- To own an amount knew paid to help you a transferor that’s an excellent grantor trust, an agent will get also influence their withholding looking at any withholding exception relevant to help you a grantor or manager regarding the faith.

- If you are revealing numbers withheld because of the another withholding representative, Form 1042-S requests the name and you will EIN of your withholding representative one to withheld the fresh tax for the the quantity required in the new Tips to possess Function 1042-S.

- If the services are performed partly in the usa and you will partially beyond your Us because of the a member of staff, the fresh allocation away from pay, aside from specific perimeter pros, is determined to the a time foundation.

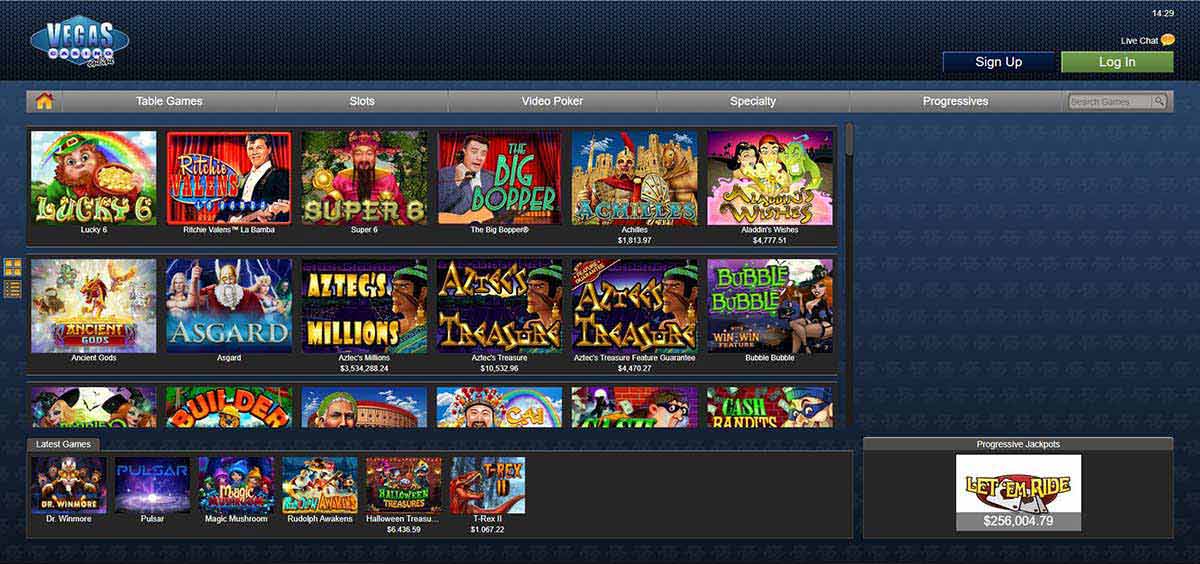

BetRivers Poker ‘s the latest model in order to an already illustrious offering from casino poker providers in the Pennsylvania. The best web site to you tend to mainly rely on the brand new state where you real time. Including, for individuals who’re within the Vegas, following WSOP.com ‘s the only games around. Alternatively, if you’re inside the Michigan, you might select from WSOP.com, BetMGM, and you can PokerStars Us, which early in 2023, merged pro pools with New jersey. Let us jump in and provide you with a listing of the fresh better real money poker sites accessible to Us participants in the 2025.

You can rely on documentary facts as opposed to a form W-8 for a cost paid back away from United states in respect to an overseas duty. Refer to Offshore financial obligation, afterwards, to determine if or not a fees qualifies as such an installment. A private foundation which was written otherwise arranged beneath the laws and regulations away from a different nation is a foreign individual foundation.